Finta’s All-In-One Master List of VC Investor Databases

Introduction

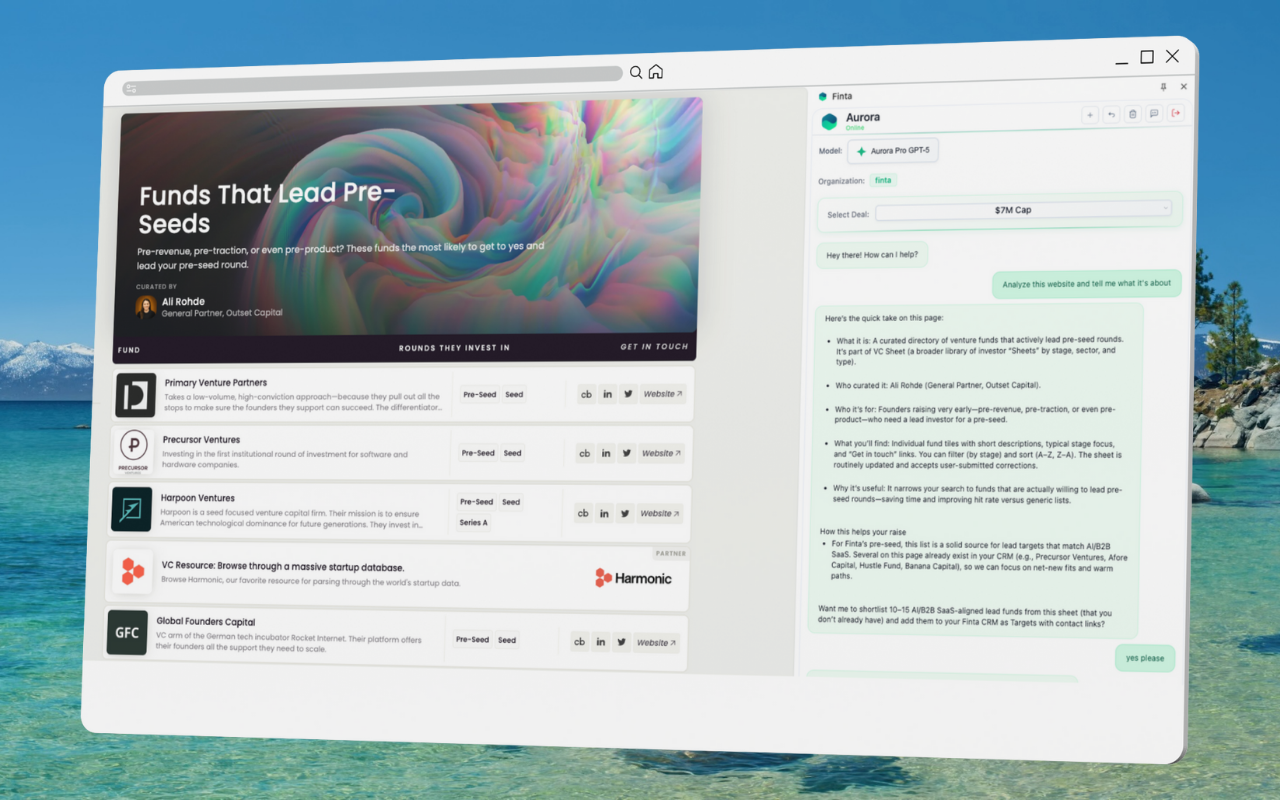

Fundraising is a critical milestone for startups, yet finding the right investors often feels like searching for needles in a haystack. Enter Finta, a SaaS platform designed to simplify this journey. Finta acts as a Capital Copilot, guiding businesses through the fundraising process from start to finish

Before you start tracking your fundraising process, are you stumped on where and how to find the right investors?

Finta’s List of Master Investor Lists

Yes, there are databases of investors, but not all are created equal. Many available databases are static, outdated, or lack critical information needed to make informed decisions.

There are many free investor lists out there. So many, in fact, that we’ve compiled nearly 40 free lists of investors for you!

Without further ado, here they are - in order of the lists with the most investors included by geographic region.

Global Investor Lists

The premier ranking of the best venture capital investors of the past year.

The #1 longest running and most credible database of Family Offices.

The investing network for Founders, VCs, Scouts, and Angels.

A list of over 6,000 global investors.

No explanation necessary - search and sort through this comprehensive list of investors that you can search by country.

A list of recent funds raised, sorted by year raised.

450+ VCs that invest in Neurotech, Biotech and Healthcare.

Sort by name, vertical, industry, and Crunchbase profile.

A list of worldwide programs to fund and grow your startup.

Fill out the form at the top to receive the full list, which was recently reduced because of too much spamming to investors. (As a reminder - don’t be that person!)

This comprehensive list lets you search by funding rounds.

True to its name - a list of investors that lead Seed rounds.

Reach out to over 5,000 investors in their database.

This Twitter thread contains valuable info on female investors.

Similar to the above - more active early-stage investors from Twitter.

Download a free sample database to search family offices.

A family office database engineered to help you efficiently identify, access, and raise.

This family office network lets you sign up to view and contact family offices.

Browse a curated list of investors, including seeing partners at funds and how to get in touch with them.

Join to explore Mercury’s database of active investors and funds.

European Investor Lists

This list includes investors who routinely lead Seed, Series A or Series B rounds in European startups, investors located in Europe, and non-European investors who frequently invest there.

This list includes 175 Web3 investors, sortable by vertical, stage, number of investments, if they lead rounds, and previous investments made.

New York Investor Lists

VC Finder is a tool to help founders form their fundraising strategy, starting with a focus on firms with a New York office. It is searchable by stage, sector, and check size.

A list of NYC investors, including information on other companies they’ve invested in.

Search a curated list of over 80 NYC-based investors and funds.

Singapore Investors

Map of the Money is the visual list of VCs and active investors in Singapore for pre-seed, Seed, Series A, Series B, Series C and Growth Stage rounds.

United Kingdom Investors

A comprehensive website for finding investors and funding resources in the UK.

United States Investor Lists

A list of over 600 VC and Seed funds, sortable by a variety of criteria.

Find investors from among more than 300 Small Business Investment Companies (SBICs) licensed by SBA.

Created by DocSend, this list lets you sort 365 VCs by stage, and if they’re taking new meetings or offering new term sheets.

Shizu’s list of 50 angel investors and VC funds that invest in startups based in the US. They rank investors based on the number of investments they made in companies from the US, and update the list every month.

Searching for Active Investors

During your investor research and outreach, keep in mind it’s good to look for investors who are actively investing - aka those who have dry powder. Otherwise, you could be targeting investors who may like your company, but don’t have the funds to make an investment at this time. It’s not that those couldn't be good connections down the line for a future raise, but those conversations shouldn’t take priority over those with investors ready to write you a check.Now, with great power comes great responsibility.

Sort Investors By Investment Thesis

As we recently covered, you want to find investors who match with your company across their investment stage, industry focus, and investment size for your current round of funding.

Finta automatically analyzes your company and automatically suggests the most suitable investors from its database of 10,000+ investors.

Research Warm Introductions

It’s always best to also take the time to try and find a warm introduction! As Charlie O'Donnell, Partner and Founder of Brooklyn Bridge Ventures writes on his blog: “Perhaps the most unfair of all of these investor scorecard factors is when the founder is known to the investor — known people are de-risked.”

Conclusion

What’s something you should keep in mind while utilizing these lists?

Remember - no mass emailing!

Use the information included, and do your own research to segment out the investors that are the best fit for YOU before reaching out. You don’t want to waste an investor’s time, just like you’d be frustrated if they asked you to pitch, knowing your company wasn’t a good fit to begin with.

There are some incredible resources curated and linked above, and we hope they help you on your fundraising journey.

If you’re looking for more help in managing your fundraise, check out Finta as well!